SHOULD YOU STILL CONSIDER INVESTING INTO THE REAL ESTATE MARKET IN 2024?

Introduction

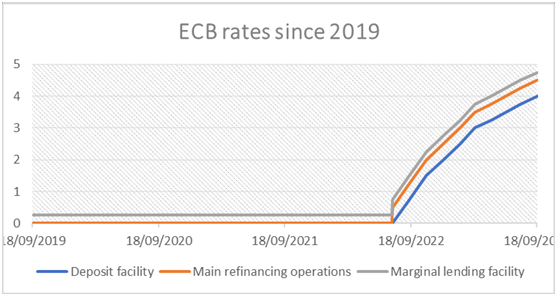

1.Credit effect

Nowadays, the price of cash is around 4.5% compared to 1% few years back. Investors tend to borrow money over a long period of time, usually 25 years. In other words, a 25 year loan of 100K USD will now cost around 75K USD in interest payments to the bank, compared to around 15K USD a few years ago.

On top of that, banks tend to be more and more risk averse. This trend not only heightens the challenges in obtaining a loan, but also contributes to a credit crunch market in which there is reduced liquidity.

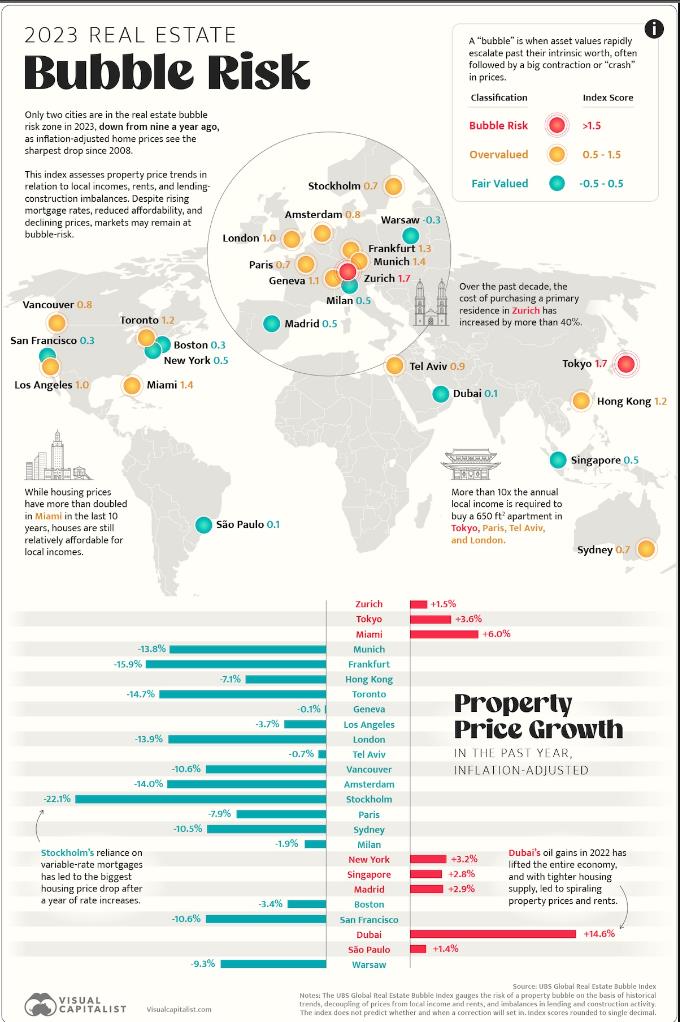

These factors will lead to a decrease in demand for real estate, which will result in a short-term loss to all estate owners. Real estate value is expected to decrease significantly at the start of Jan 2024.

2.Inflation effect

Another dimension to take into consideration is the change in the global economy’s regime. After years of low inflation, during which central banks sought to stimulate inflation through expansionary monetary policy, we are now living with an inflation around 8%.

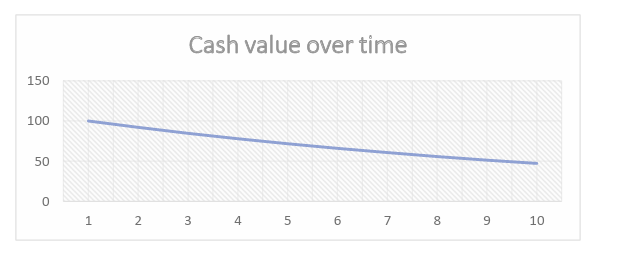

Inflation means that the real value of your cash decreases every year. The 100K USD in your bank account will only be ‘worth’ 92K USD in real term, in other words, inflation lowers your purchasing power.

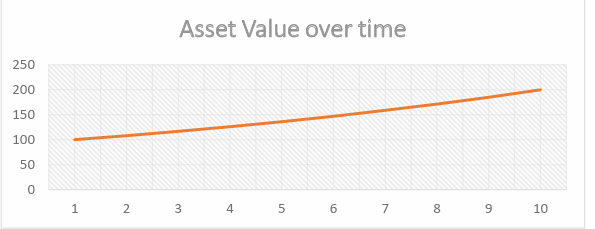

On the other hand, and in an imperfect manner, assets tend to appreciate in line with inflation. Gold, diamonds, luxury watches and… real estate are always better than cash to protect your wealth. During periods of high inflation, investors prefer shorting cash and going long on assets, meaning disposing available cash to buy assets.

Considering this second dimension, it’s better to have cash in real estate than keeping it in the bank where it’s depreciating every year. The misleading idea is that we compare rates to an abnormal situation where it was 1% a few years ago to the current rate. Borrowing cash at 5% is historically speaking quite low/average.

3. Debt value over time

Conversely, the value of debt takes the opposite direction. Over time, the value of the investors’ loans decreases. Your loan will be refunded following an equal instalment every month. 1,000 EUR that you pay back to the bank now is relatively heavier than repaying 1,000 EUR in 25 years, because of the depreciation of the value of the cash as discussed earlier.

4. Investing in Real Estate is playing with the Cash-Asset spread.

Conceptually, an investor should not consider investing in real estate by comparing the premium of buying the loans and the potential capital gain due to his asset appreciation. The main point of iinvesting in real estate is to benefit from the unique advantages that cannot be obtained from other asset classes: banks will always consider financing an investment in real estate, but not gold or diamonds.

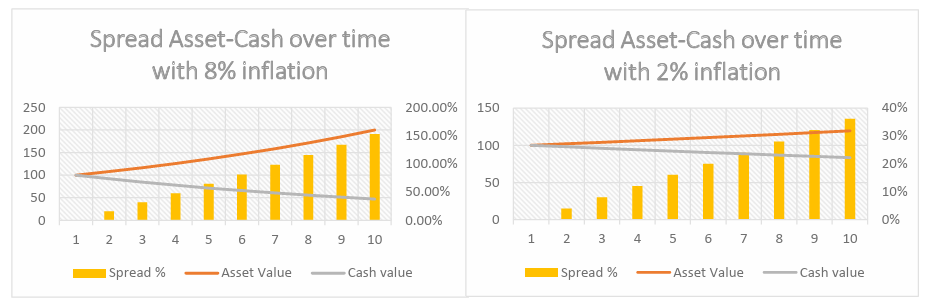

Hence, investors should consider the cash-asset spread in terms of the relative appreciation depreciation:

When inflation rates are high, the spread is relatively higher compared to when rates are low. In that case, it seems high rates favor real estate investment as the value of assets will increase more overtime while the debt burden will tend to decrease drastically faster.

5. Power relationship owners/tenant

As stated earlier, it’s now more expensive and difficult to obtain loans from the banks. In this context, most individuals will postpone their buying projects, leaving the market with a lot more people looking for rent as they couldn’t buy their house. The increasing demand for rental properties will induce a global increase.

On the other hand, demand for properties (both buying and/or investment purposes) is collapsing, putting a downward pressure on property prices.

As a result, we are in a place where price of the property is decreasing while its induced cash flow is increasing. This trend again demonstrates that it’s still relevant to invest in the real estate market.

6.People are chickens

Is the market ‘bear, bull or chicken’? In fact, everyone is just a chicken and prefers to adopt the ‘wait and see’ strategy. But when inflation is increasing every week, not acting is a big investment decision. By not investing in any assets, the decision is to go long cash and betting that cash will outperform all the other asset classes.

Friedman described this phenomenon as the ‘lag effect’, salaries take time to adjust to inflation level because people take time to understand their cash value is decreasing in real terms. Similarly, people know – and even understand the concept of inflation – but most of them prefer to wait to see where the market is going. It makes sense, as multiple factors illustrated in this article must be considered: credit/inflation effect, relative debt value over time, and rent/assets value effect.

As an investor, taking action should be the main driver of wealth generation. Rather than perceiving holding onto cash as a chicken decision, it can be viewed as a stance in response to an extremely bearish market.

7.When is a good entry point into the market?

Now, individuals are trying to determine whether it’s a good time to enter the debt market.

‘Well, I think rates are going to keep increasing till January and then central banks will decrease the rates’ All of that does not really matter.

First, multiple factors can affect the interest rates in the economy, and it would be a bit pretentious to think someone could predict where rates will go.

Most important, fixed-rated contracts with banks are only fixed rates for the bank: – –

– If rates increase, the bank cannot increase the rate they are charging you, it is contractual.

– Alternatively, if rates decrease below the rate you agreed with the bank, any individual can go to any other bank to ask them to buy back the loan from their competitors. In other words, another bank can offer you a loan at the current rate for the outstanding principal. In practice, most people just ask their banks to readjust at the current rate and they effectively do it as they know people can just go to their competitors to get the current rate.

In hindsight, the best time to invest was 2 years ago when the entry point was at 1%. The next best entry point is today.

8. Who are the winners of this context and will how they take advantage of the current market’s conditions?

Three kinds of people will take advantage of the current context: – – –

-People with a portfolio loaded of cash and able to short a lot to buy assets at discount.

-Action takers still eager to spread cash-assets in the real estate environment.

-Flexible people able to reinvest their portfolio by realizing their gains and reinvesting in devaluating markets. For example, Short UAE / Long EU is the 2024 strategy?

Also, investors need to consider alternative investments, including:

-

- Bid auction, high interest rates will increase the number of defaults.

-

- Primary markets, constructions companies will suffer from low demand and difficulty in finding financing.

-

- Developing markets to diversify the portfolios, the easy way isn’t going to be enough anymore in tough times.